How performers can register as self-employed and what is tax deductible as an actor.

Being a performer requires a lot of work – you have to learn lines, film self-tapes and go to auditions – all while juggling the rest of your life. Self-employed actors in the UK also manage their financial aspects and are responsible for tax and National Insurance contributions.

Getting to grips with all of this can seem overwhelming at first, but there are millions of self-employed people across the UK, so don’t worry. If you’re self-employed or about to register as such, this guide will help you navigate the process and provide helpful tips.

Is an Actor a Sole Trader?

Actors only need to register as self-employed once their income exceeds £1000 in a tax year, after which they need to submit a tax return.

- Once your turnover reaches this amount, you will need to set up as a sole trader by registering for Self Assessment with HMRC and need to register by 5 October after the end of the year you become self-employed.

- As a sole trader, you work for yourself, meaning you can keep all the profits and are responsible for all the losses.

- You must also follow certain rules on running and naming your business, although most actors trade under their name.

- You can be employed and self-employed, meaning you can still work a PAYE job alongside acting work.

An actor’s income can fluctuate throughout the year, but you need to put money aside for tax so you have enough to pay your tax return. “The amount to put aside will depend on current/expected earnings and could be anywhere between 20-50%, depending on levels of income.”

How Actors Can Register as Self-Employed or a Sole Trader

This is a straightforward process and the first step is registering for Self Assessment, which is a system HMRC uses to collect income tax. You will need your National Insurance number and personal information, such as an address and contact details, to complete the process.

Unique Taxpayer Reference

Once you’ve completed the Self Assessment, you will get a Unique Taxpayer Reference (UTR), a 10-digit number you receive in the post 10 days after registering. Keep the letter safe; you will need your UTR for your tax return.

VAT

As a sole trader, you must register for VAT if your turnover is more than the current threshold, which can be found here.

Keeping Records and Receipts

Keeping accurate records throughout the year will make filing your tax return a much easier process.

The information you need to keep records of according to HMRC are:

- All sales and income

- All business expenses

- VAT records (if you’re registered for VAT)

- PAYE records (if you employ people)

- Records about your personal income

- Your grants, if you claimed through the Self-Employment Income Support Scheme – check how much you were paid if you made a claim

You don’t need to send any of these records to HMRC when you submit your tax return, but you must keep all of them for at least five years after the 1 January submission deadline of the tax year, as HMRC might request to check your records at a later date.

Key Dates for Filing Taxes

The Tax Year

A UK tax year, also known as the financial year, runs from 6 April and ends on 5 April. For example, the 2023/2024 tax year runs from 6 April 2023 and ends on 5 April 2024.

Tax Return Deadlines

- Paper tax returns need to be completed by 31 October after the end of the tax year.

- Online tax returns need to be completed by 31 January after the end of the tax year.

If your tax return is submitted after the deadline, HMRC will enforce penalties, the amount of which varies depending on how late the tax return is filed.

Claiming Expenses and What is Tax Deductible as an Actor?

Being a performer is not cheap and essential expenses such as headshots, classes and travel quickly add up, so it’s good to know that many of these are tax deductible. Actor Hub has written a great, in-depth article on the subject and you can see examples of things that are tax deductible below.

- Clothing, makeup and props, if bought for work in theatre, film, or TV performance. You cannot claim for something you wear to an audition.

- Travelling for research, such as train travel and petrol costs, including theatre and cinema tickets, and any books or plays used.

- Assets that are purely used for business purposes, such as computers, mobile phones and software like Microsoft Office. Anything that is also used personally will only be allowable on the business use element.

- Household bills – if you use your home as a home office, then a percentage of certain household bills are tax deductible. More guidance on these can be provided by HMRC.

- Education and accreditations– relevant to your profession, such as acting/dance/singing classes or a course.

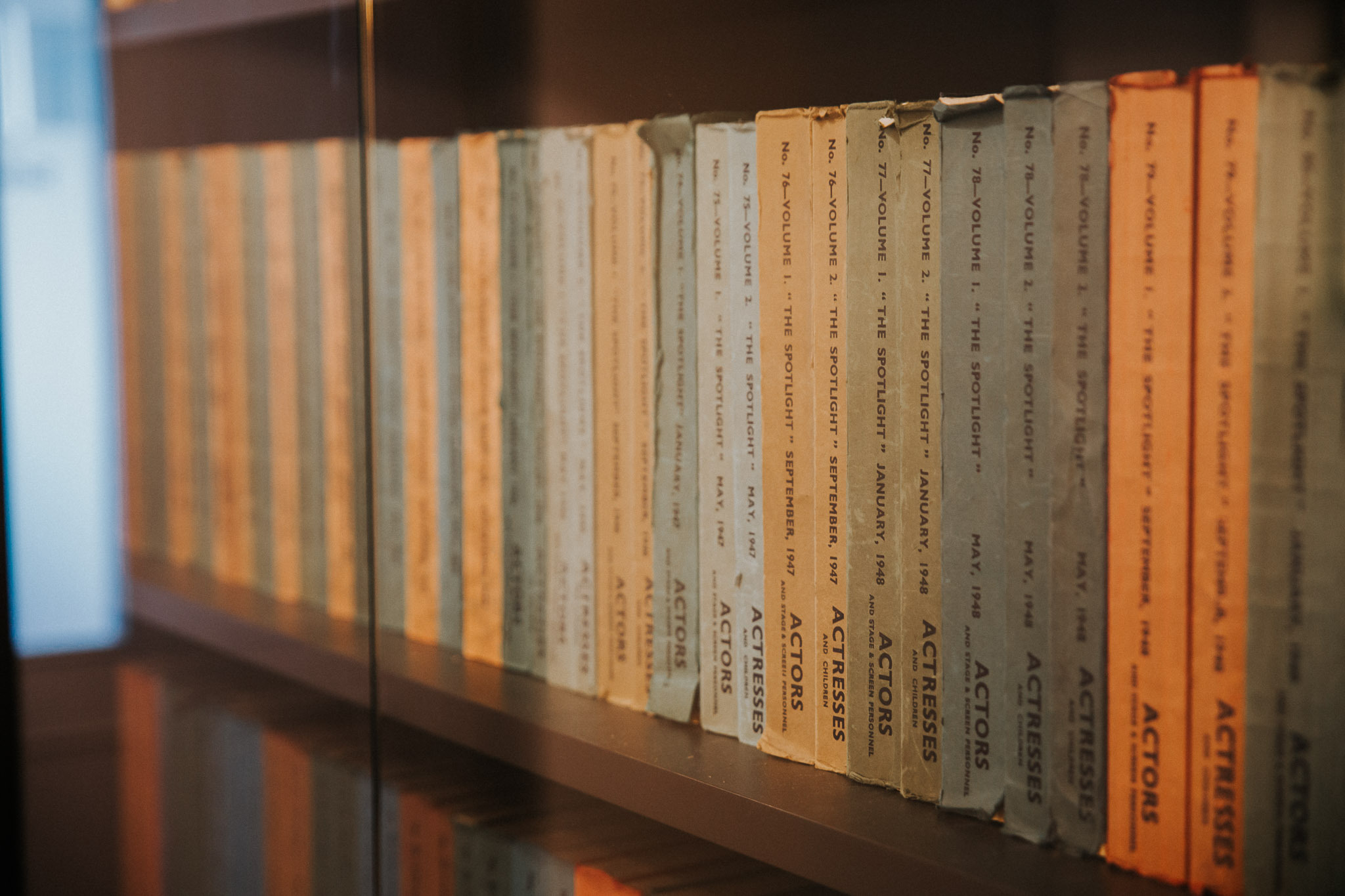

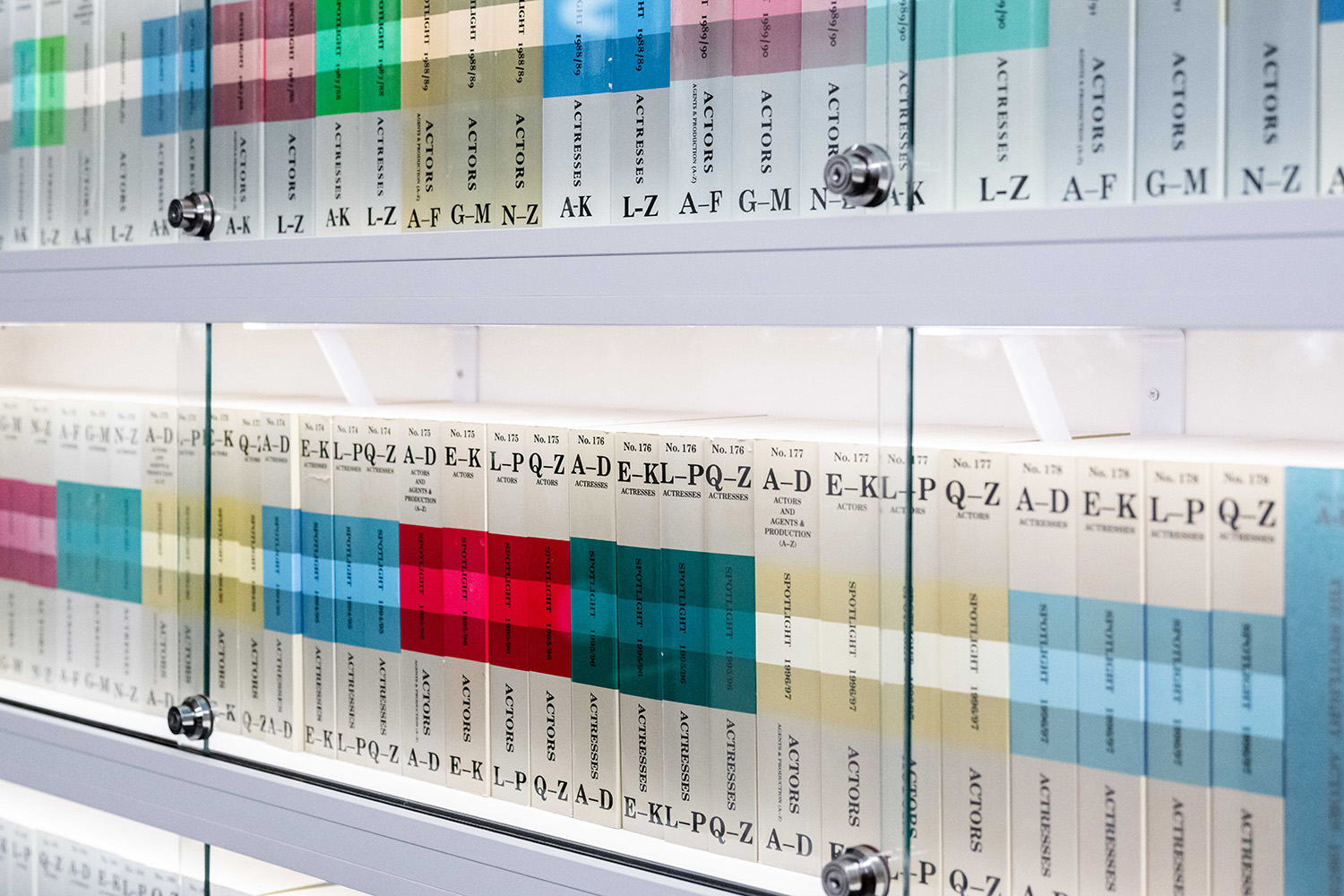

- Subscriptions and memberships such as Spotlight. That’s right – your Spotlight membership is tax deductible.

- Agent fees.

What is the Tax Return Process?

There are two methods to file a tax return, either in paper format or online.

Paper Tax Return

A paper tax return needs to be submitted by 31 October following the end of the tax year. To submit a paper return, you call HMRC and request an SA100 form or download one from HMRC’s website.

Online Tax Return

An online tax return has to be submitted by 31 January following the end of the tax year and you will need a Government Gateway account to do this. You will require your Unique Taxpayer Reference (UTR) number to register for an account.

You can save your tax return as you go and come back to it at a later date if needed, but having all the records you need beforehand will make the process easier. Once you’ve filed your tax return, HMRC will calculate what you owe based on the information you’ve given.

Do I Need an Accountant?

It really is personal preference as to whether you feel the need to use an accountant or not to assist with filing your tax return. Some people prefer the reassurance of using a qualified professional, others find the process straightforward, especially if you keep detailed records of your income and expenses.

Search here for a local accountant through Spotlight Contacts

How Much Does an Accountant Charge?

You can also choose to go to an accountant specialising in performers. The Showbiz Accountant offers a flat fee of £350 for a tax return and Accounting 4 Actors will submit your tax return for £239 plus VAT.

Bookkeeping is the general day-to-day upkeep of your financial records and some performers find doing it themselves via a spreadsheet sufficient. Others prefer using accounting software such as Quickbooks or Zoho Books, which are affordable options to keep everything in one place, such as receipts and invoices. Setting up a business bank account is also an option, if you want to keep your performing income separate from your personal banking – but not necessary.

The income of a performer can vary, but it’s essential to get into a consistent routine of keeping accurate records and putting aside tax as soon as you get paid from a job as this will create time to focus on developing your professional career.

Take a look at our website for more advice for self-employed actors and acting tips.

Sarah Ridgway trained as an actor and has dabbled in stand-up comedy. Sarah is now a freelance writer, and her credits include Backstage and Actors Pro Expo; she is also passionate about empowering solo female travel.

Sarah Ridgway trained as an actor and has dabbled in stand-up comedy. Sarah is now a freelance writer, and her credits include Backstage and Actors Pro Expo; she is also passionate about empowering solo female travel.

Headshot credit: Sarah Ridgway