How to plan your spending as an actor to ensure you’re saving enough when your income is high and surviving when work is slow.

One of the biggest obstacles to self-employed actors getting a grip on their finances is a failure to budget properly for their irregular income. It’s easy to spend freely when earning a good income and reign it in when work is slow, but this isn’t a sustainable way to manage your money.

Creating a realistic budget and sticking to it is the only effective way to learn how to manage finances as an actor. Budgeting for irregular income puts you in control, helps you reach your personal savings goals and removes the stress that comes with uncertainty about your future.

Understand Your Spending

First, you’ll need to carry out a thorough analysis of your spending for the last 12 months. Start by calculating how much you earned in each month and work out the average. Look out for any months that were particularly high and don’t reflect a realistic example of your earnings. If there are only one or two of these, consider leaving them out of your calculations.

Don’t ignore the lowest month, even if you earned significantly less than the average. This should be your base level, used to work out what you can afford to spend when times are toughest.

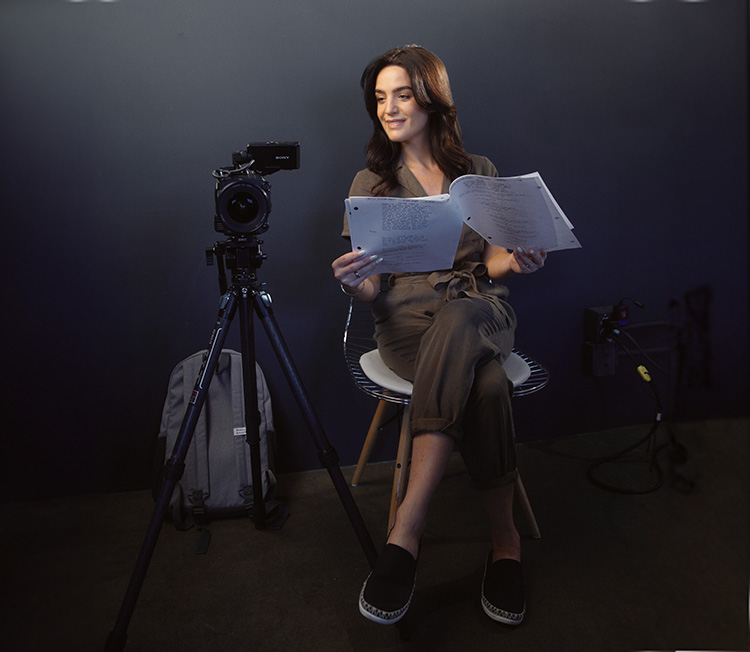

As you go through your spending, make a note of essential expenses. The obvious ones are rent/mortgage, utilities, council tax and travel costs. You’ll also need to factor in essential business costs such as your Spotlight membership, costumes, phone contract and admin costs.

Reducing Your Outgoing Costs

Most people’s biggest monthly outgoing is the cost of housing. As an actor, you’ll want to be close to where the action is (i.e. London’s West End), but these are often the most expensive places to live.

Consider moving outside the city to somewhere with lower housing costs if possible. These days, self-tapes are common for first auditions, so it’s not always necessary to be in the heart of the city. As long as there are good transport links, weigh up the costs of cheaper rent and frequent travel with paying higher rent in the city centre.

If you already have an inner city tenancy, consider taking in an extra flatmate or downsizing when the contract ends. Both can help reduce rent and utility costs. Where possible, look for rental properties where the monthly payment includes utilities. This makes budgeting easier and can help protect against price increases.

Take a flexible approach to housing, but don’t accept anywhere unsanitary, unsafe or claustrophobic. A career in the arts requires good mental health and you’re the biggest asset your business has.

If you’re starting as an actor after graduating from drama school, this is still a valuable exercise. You’ll still carry out a comprehensive review of your spending, which can determine how much you need to earn from acting or other work to meet all your commitments.

Dealing With Debt

Student Loans

Lots of performers have student debt. If you’re working part-time while auditioning, the chances are you won’t earn enough from that job to meet the minimum threshold for making student loan repayments.

Assuming your income from acting work takes your total earnings above the repayment threshold, your student loan costs are added to the tax bill you get after submitting your self-assessment form.

Credit Card Debt

If you have other loans or credit cards, factor these repayments into your essential expenses. For credit cards, try to pay more than the minimum monthly payment. While it can be tempting to pay as little as they’ll allow, the debt will last longer and your overall costs will be higher.

If you’re struggling with debt repayments, don’t ignore it. Modern creditors are sympathetic to customers with payment issues and will work with you to establish an affordable repayment plan.

Get in touch with them as early as possible and try to work out a way of maintaining full payments if possible. Even reduced payment arrangements show as arrears on your credit file, which can harm your long-term borrowing options.

Whatever you do, don’t be tempted to pay a debt management firm. They won’t do anything you can’t do yourself but will take a cut of every payment you make. Debt can be overwhelming, but organisations such as the Citizens Advice Bureau, StepChange and National Debtline offer free, independent advice.

Always look to cut back on spending before resorting to debt. Once you get into the debt trap, it’s hard to escape.

Other Ways to Save

Food Shopping

You have greater control over grocery spending than you do over most essentials. Look for stores with the lowest prices and take advantage of points cards that offer rewards. They’re only small, but saving a few pounds once a quarter or enjoying a ‘free’ treat once in a while will help keep you on track.

Most supermarkets offer deals such as ‘2-for-1’ or ‘buy two get the third free’. If you go shopping with a friend or as a group of housemates, you can use these to spread the cost rather than paying the full price individually. The key is not getting tempted and just spending the amount you saved on other goods.

Loyalty Cards

Lots of hairdressers and coffee shops now offer loyalty cards, too.

Business Expenses

If you need a haircut for your headshots or a particular role or audition, this can be classed as a business expense. Your Spotlight membership is also a tax-deductible business expense.

Monthly Subscriptions

It’s a good idea to regularly review your subscriptions. A 2024 survey by YouGov showed that 50% of Brits pay for monthly subscriptions they never use. It’s also worth looking at whether the subscriptions you use provide value for money. Do you really need them? Is there a free or cheap alternative that would suffice?

Managing Your Budget as an Actor

It can be tempting to splash out during your high-earning months and make the most of having a bit of spending money. While treating yourself shouldn’t be completely off the table, you should also put money away to get you through the lean times.

With a fluctuating income, building up an emergency fund of three to six months of essential expenses is advisable. Knowing you have a buffer limits money worries and allows you time to make good career decisions.

Without a buffer, you might be tempted to accept low-paying jobs you’d otherwise refuse. While working on these, you won’t be able to audition for more lucrative roles and could soon find yourself back at square one.

Your buffer should be stored in a separate savings account that you top up monthly. If you’re not sure you can trust yourself, pop into your local branch and ask what options they have for a savings account without instant access. This can help prevent dipping into your savings on a whim.

Until it reaches at least three months’ worth of essential spending, you’ll need to limit your spending and keep things tight. Cutting back on holidays, nights out or other luxuries might not sound appealing, but you have an advantage over others in your situation – you’re surrounded by creative minds in the same position. Staying in and cutting back is an opportunity to find new and interesting ways to socialise and have fun.

You might have heard about the 50-30-20 rule that some freelancers use. It involves putting 50% of your wages into essentials, 30% into wants and 20% into needs. It’s a nice theory, but the numbers don’t always add up.

It’s better to work out how much you need for your essential living expenses and how much you want to save, then plan your wants around how much you have left.

Plan for the Future

Building a buffer is one way of planning for short-term financial issues. In the slightly longer term, you’ll need to save for your tax bill. It’s best to put aside 25% of everything you earn into a separate savings account for this.

Take a look at our tax tips for self-employed actors for more information about paying your taxes.

It’s also advisable to start paying into a pension as soon as you start working. Check out our guide to pensions for actors to find out more about your options and advice.

You’ll also need to think about other financial goals. If you’re saving to buy a house, want to learn new skills to broaden your job prospects, or have plans to one day fund your own creative venture, you’ll need to factor this into your monthly expenses.

There are several options available when it comes to opening a savings account, including:

- ISA

- Premium Bonds

- High-Interest Savings Account

For further details, check a trusted online site or speak to your bank. For large investments or anything that involves risk to your money, speak to a registered financial advisor.

Find a Budget Planner That Works for You

There are plenty of budgeting apps available that make sure you always have access to your budget planner in your back pocket. Most major banks now offer budgeting services in their apps, too.

You might prefer a simple spreadsheet, a planner on your wall or a budget planner template. It doesn’t matter what system you use, but it’s important to record your budget and find an easy way to check your spending against the goals you’ve set for yourself.

The Importance of Sticking to Your Budget

A budget planner is only worthwhile if you stick to it. In an ideal world, you won’t be met with any unexpected expenses until you’ve had time to build an emergency fund and no emergency will ever be more expensive than what you have put aside.

Then again, in an ideal world, you’ll be in full-time acting work, earning a high salary from the moment you graduate. Life doesn’t always work out that way, so you need to be flexible.

Budgeting sets you up to manage your finances sensibly for the short and long term, but you need to regularly review it, maintain an agile mindset and stay disciplined.

Get it right, and you’ll be free to focus your time and effort on being the best version of yourself, smashing those auditions, and enjoying a long and successful career as an actor.

Take a look at our website for more tips and advice for self-employed actors, including: